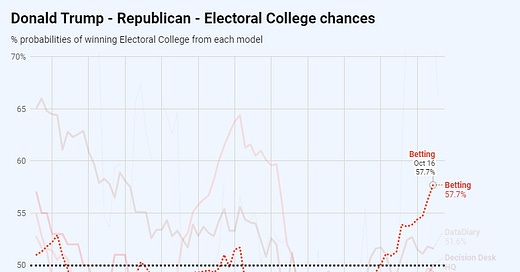

As of 16th-17th October - three weeks to go - this is the position with all the major polling models and with the betting markets.

Most of the models have the race as a dead heat, or within a percentage point or so of the mid-line. And over history, the betting markets have largely been following their consensus. That is, if you shaded the area between the highest and lowest estimate from the models for each candidate, you’d find the betting markets in this range. Which would make sense if both they, and the betting odds, were reacting to the best information available.1

But the betting markets, starting on about the 7th October, diverged from this range covered by the models. This move was led by Polymarket - where close watchers of the betting quickly realised that one large account was driving the majority of the betting for Trump. This pushed his odds up to around 62%, before falling back to the high fifties.

Other markets followed a little later, and in less extreme ways. The series of moves could simply be other traders reacting to the arbitrage opportunities. But the original market trader remained in the background and added further to their positions, generating a great deal of speculation on their motivation.

Why are they doing this?

This saga has been well-documented by Rajiv Sethi in a set of articles that run through the evidence for an original “Fredi9999” account having expanded to several others, with at least $25m on Trump. There is also (rather circumstantial) evidence of some of these accounts being linked to a person going by the name of “Michel” who appears to be a French national, claims no political allegiance either way, but claims that it is clear to them that Trump’s probability is closer to 75% than to the prevailing market price.

There seem four possible motivations:

Genuine belief that Trump is under-priced from public information (i.e., that the true probability of their winning is significantly higher than 50-ish% percent). This is what “Michel” claims, denying any political motivation or special access to information.

Genuine belief that Trump is under-priced from private information (e.g., knowing about internal polling, unrevealed stories, strategies, candidate health issues that are likely to become public in the next few weeks, that would tilt the race towards Trump).

Market manipulation for political reasons - believing that it will help Trump to be seen as further ahead just a couple of weeks out from polling day. And so putting money into the market to spread that narrative.

Market manipulation for financial reasons - the so-called “pump and dump” move, where you put in enough bets that the “trend becomes the story” - others pile in assuming you know more than them (i.e., they assume that you are operating for reason '#2) and then you sell at a profit.

When major outlets have written this up, they tend to emphasise one motivation or the other.

The Wall Street Journal - putting the number above $30m - lean towards #3 - market manipulation to make Trump appear further ahead than he actually is for political reasons (though what these are isn’t entirely clear).

The Financial Times writes up the same situation, but leans towards #1 - a genuine belief that Trump is significantly underpriced. Sethi himself seems agnostic, but leans somewhat towards #4 - the possibility of a “pump and dump” motivation, though Fredi9999-and-friends seem to be holding on to their positions for now.

Also, recall that something like also happened in 2012, when the so-called “Romney Whale” was responsible for around a third of all trades made in favour of Mitt Romney to win, and kept the contracts right though to election day (they are estimated to have lost around $4m in doing so). Professor Sethi was the one who most comprehensively analysed this single trader in a series of academic papers (which also touched on various theories of market structure) - hence his interest in a 2025 re-run.

So, what is going on?

Well, clearly and most obviously, we can be fairly sure that there is currently a premium on Trump on several betting markets driven - most probably - by the activity of one single very deep-pocketed agent.

At a reasonable guess based on the order book that is made public, this premium is around +5ppts more on Trump versus where the market would settle if this one agent’s trades were removed. And this would take the price back into the low 50s - into the range shown by the models.

There is no evidence that Fredi9999 has privileged information (e.g., internal information from either campaign), though right now they are doing well in terms of being ahead of the crowd. Since October 7th, the polling has moved a few fractions of a point towards Trump, so if Fredi9999-and-friends liquidated their positions right now, they would make a sizable profit - hundreds of thousands of dollars. However, given the size of their bets, it’s likely they would not consider such a profit a substantial one.

So, given this evidence, I would suggest that betting markets are distorted by one particular participant, who has no particular reason vs any other person to be right about the chances in the upcoming election.

But they do have a lot of money,2 a set of beliefs about the result that is out of the usual range, and they want to bet on these beliefs.

The motive (almost) doesn’t matter

If all we are interested in is the clearest, most faithful reflection of the truth about the state of the race, we don’t actually need to determine which reason is correct. Or, to be more precise, we don’t need to distinguish between #1, #3 or #4. In all these cases, we should just discount the betting markets by (most of) 5ppts and continue as normal.

Just to quickly see why: considering reasons #3 and #4, we have a deliberate attempt to distort the markets as an objective aggregator of information, and this attempt is succeeding. We should discount it.

In the case of #1, we do not have deliberate attempt to distort anything - it is a genuine belief that should be counted in the “wisdom of crowds” interpretation of the betting markets. The issue is, it is being counted with far too much weight, because they are putting $25m-$30m into the markets based on it. Whatever your belief about the weight we should give to richer people’s opinions, it should not be literally tens of thousands of times more weight than others. This is particularly true when - most likely - the source of their wealth has little-to-nothing to do with predicting political races.

Therefore, we might want to weight this belief a little more than other participants (because of their willingness to put much more money against them), but nowhere near how they are being counted. And the first approximation to this number is - again - to remove their distorting presence frm the market. Which takes us back to taking about 5ppts off the price while these positions continue to be built.

The only case in which we should not discount the “Fredi premium” is #2. If we believe that this person has privileged information that justifies the amount of money they are willing to put at risk. And - frankly - the evidence for this is thin-to-non-existent. Internal party polling tends to paint a very similar picture to public polling,3 so having access to this information wouldn’t change anything much. A hidden scandal, or concealed medical condition of one of the clients would be a different matter - especially if there were some reason to think that this was going to be made public before November 5th, but one would expect this to have come out by now for maximum damage. There is a reason it’s called an “October Surprise”.

So, tentatively, I think those engaged in truth-seeking have a clear way forward. We discount all, or almost all of the Fredi-premium (say - 4ppts out of the roughly 5ppts total4), and view the betting markets as fundamentally communicating a ~53% chance for Trump / 53% for Harris, which puts them back into the range of the indicators we spend most of our time looking at - the poll-based models, which are showing almost exactly these numbers at the moment.

Or if bettors in the markets had decided that the models were in fact themselves the best information available.

Your politics will likely dictate whether you think that this means that more weight should be given to their opinion than anyone else’s.

In fact, evidence from close races suggest they can be worse = more biased, because of the pressure on the pollster to tell the client what they want to hear.

The smaller discount to take account of a) reweighting the huge betters b) the possibility of motivation #2 being correct.

Not entirely sure how your 5ppt is determined but if others have piled in on the basis of fredi's distortion of the market then should you be discounting at a higher level maybe?

Who here doubts that "Michael" is backed by Vladimir Putin, Elon Musk, or both?